Arizona Sales Tax Rates 2025

Arizona Sales Tax Rates 2025. Consumers use, rental tax, sales tax, sellers use, lodgings tax and more. Some of the arizona tax type are:

Then, identify the local sales tax rates, varying across counties, cities, and districts. These records are crucial for filing your sales tax return with the arizona department of revenue.

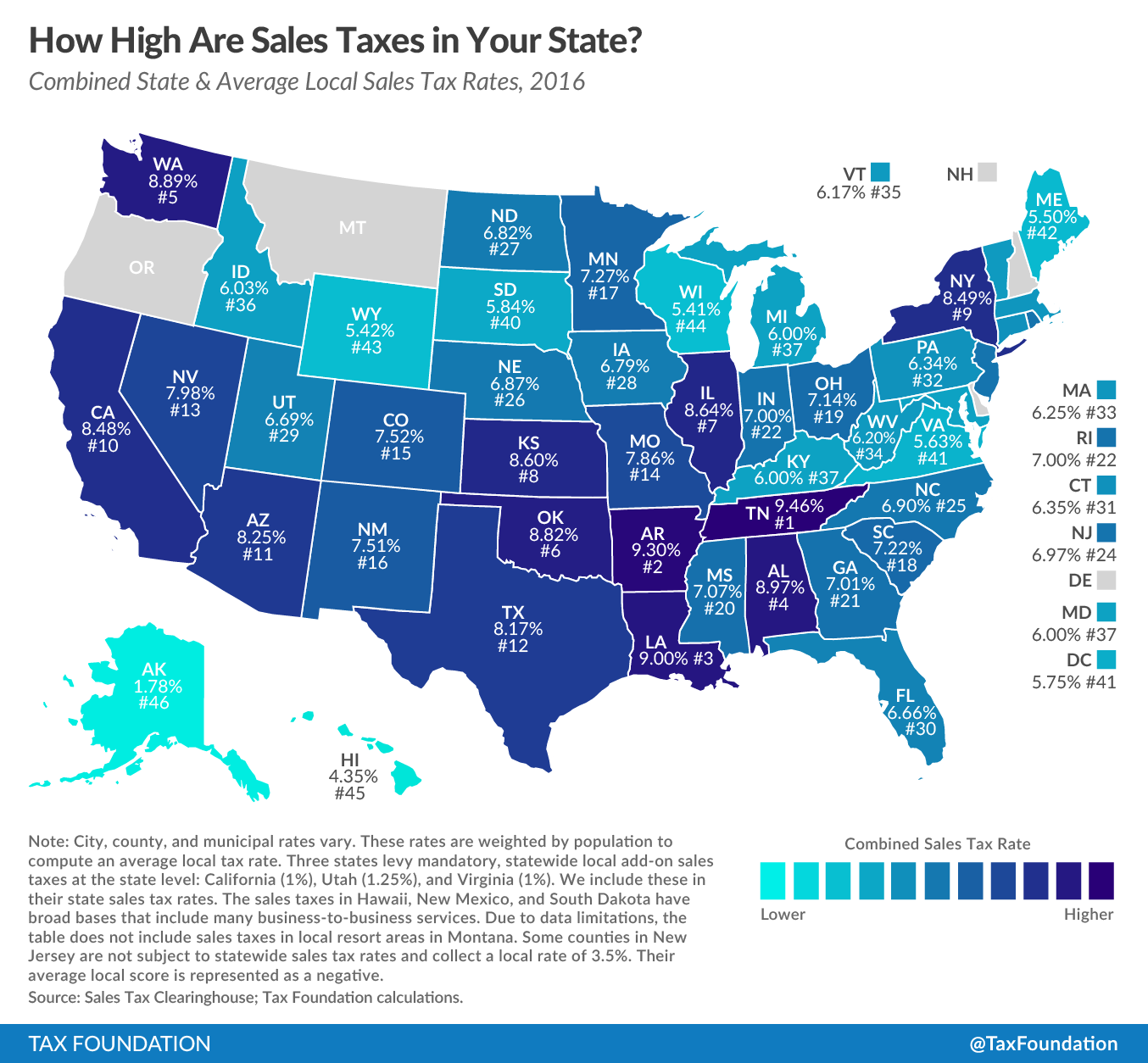

Monday Map Combined State and Local Sales Tax Rates, The arizona's tax rate may change depending of the type of purchase. These records are crucial for filing your sales tax return with the arizona department of revenue.

.png)

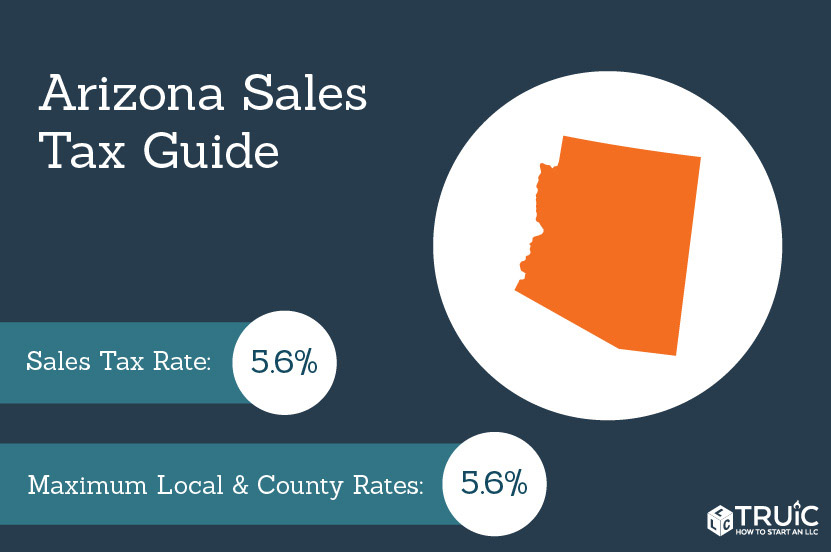

Arizona Sales Tax Calculator 2025 State, County & Local Rates, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. However, please note that tax rate changes.

Arizona Tax Brackets 2025 Elke Nicoli, Look up 2025 sales tax rates for goodyear, arizona, and surrounding areas. This comprises a base rate of 5.6% plus a mandatory local rate of up to 5.6%.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Tax rates are provided by avalara. The arizona sales tax rate is 5.6% as of 2025, with some cities and counties adding a local sales tax on top of the az state sales tax.

How High Are Sales Taxes in Your State? Tax Foundation, Then, identify the local sales tax rates, varying across counties, cities, and districts. Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.

Sales Tax Expert Consultants Sales Tax Rates by State State and Local, The arizona sales tax rate is 5.6% as of 2025, with some cities and counties adding a local sales tax on top of the az state sales tax. The average sales tax rate in arizona in 2025 is 5.6%.

Arizona Sales Tax Small Business Guide TRUiC, Tax rates are provided by avalara. The arizona sales tax rate is 5.6% as of 2025, with some cities and counties adding a local sales tax on top of the az state sales tax.

Arizona Sales Tax & Audit Guide for Businesses, What is the sales tax rate in maricopa county? Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.

Ultimate Arizona Sales Tax Guide Zamp, The arizona's tax rate may change depending of the type of purchase. Look up 2025 arizona sales tax rates in an easy to navigate table listed by county and city.

What is the Combined State and Local Sales Tax Rate in Each US State, Additional sales tax is then added on depending on location by local government. The average sales tax rate in arizona in 2025 is 5.6%.

8.37 percent (average combined state and local) the state sales tax is 5.6 percent, but most counties and cities add a local tax that can raise combined.